The last financial year has been challenging for us all – our customers, our employees, and our business. We’ve come face to face with a tough economic outlook, but we are ready for what is to come, and we are proud of what we’ve achieved.

The changes we are making are already improving the customer experience. Our finances are sound, enabling us to invest for the long term. We have built more homes and our development pipeline is strong.

This Annual Report shows that the decisions we are taking today are shaping Sovereign’s future. Together we are creating communities in which people can thrive, building homes that have a positive impact on the environment and making a difference in the world.

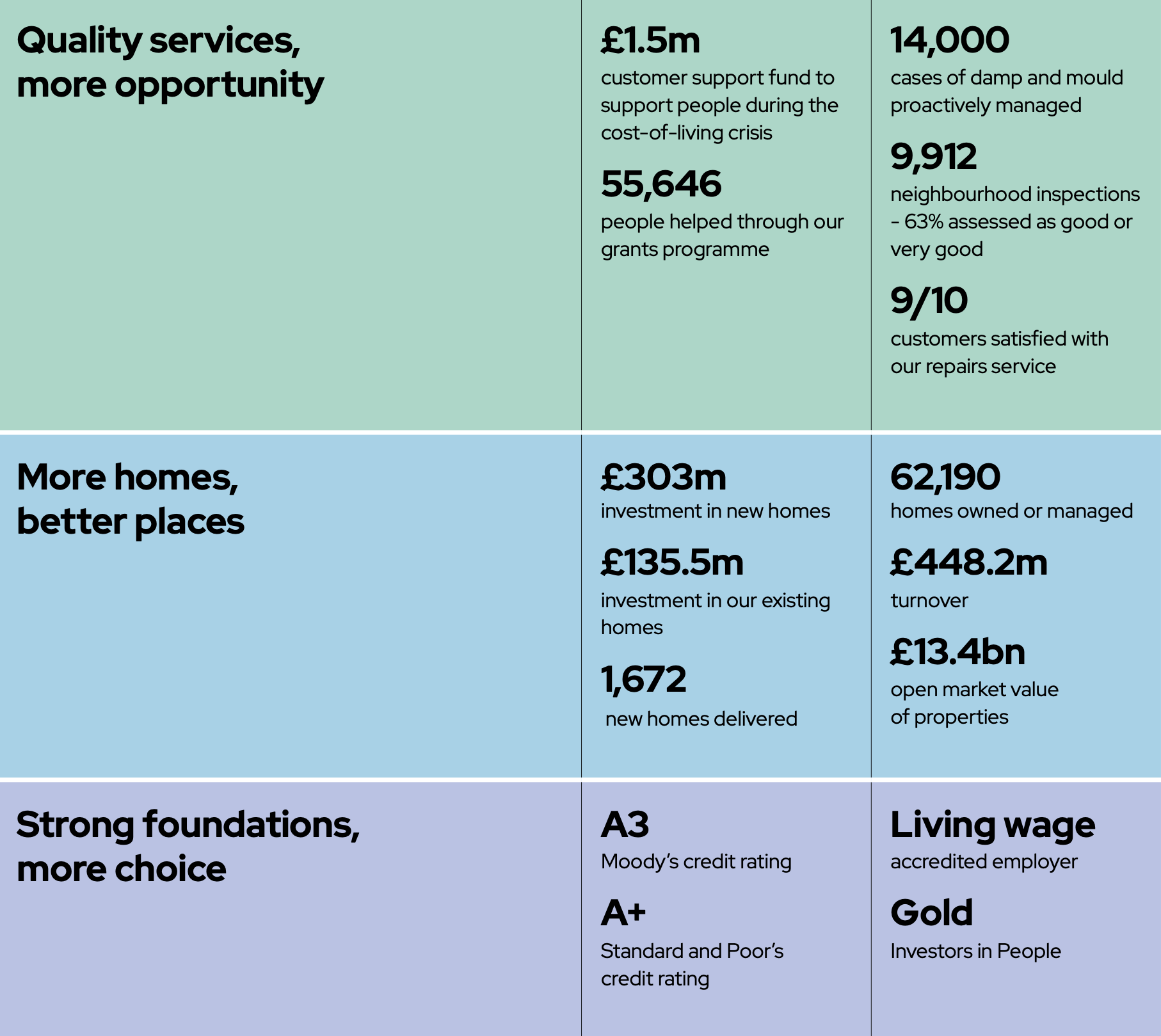

The year in numbers

A strong financial position gives us a great platform to continue to deliver the high quality homes and services our customers and our communities expect and deserve.